Green Logistics Market Size to Lead USD 3,314.3 Bn by 2034 Driven by Decarbonization and Sustainable Supply Chain Initiatives

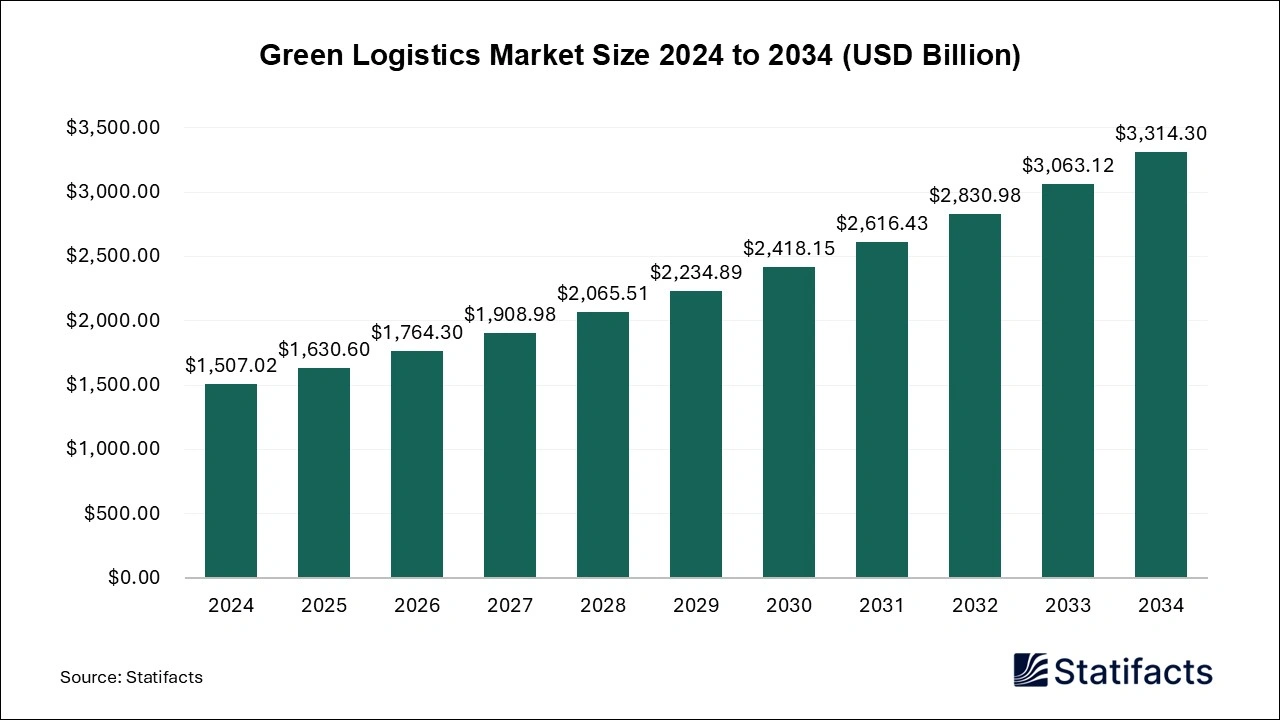

The global green logistics market size is predicted to increase from USD 1,630.6 billion in 2025 and is anticipated to be worth around USD 3,314.3 billion by 2034, expanding at a CAGR of 8.2% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Oct. 16, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global green logistics market size reached USD 1,507.02 billion in 2024 and is estimated to attain USD 3,314.3 billion by 2034, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. Operational cost savings, improved CSR objectives, innovation in green technologies, rising demand for sustainability, and stricter environmental regulations are driving the growth of the market.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/8240

Green Logistics Market Highlights

- Asia Pacific led the market in 2024, driven by rapid industrialization, growing e-commerce activity, and government initiatives promoting low-emission logistics solutions.

- North America is projected to record the fastest growth from 2025 to 2034, supported by strong sustainability mandates, advanced logistics infrastructure, and widespread adoption of electric fleets.

- By business type, the warehousing segment captured a substantial share in 2024, owing to the increasing integration of automation, energy-efficient systems, and smart inventory management solutions.

- By business type, the distribution segment is anticipated to witness the highest growth rate during 2025–2034, fueled by rising demand for last-mile delivery optimization and green freight operations.

- By mode of operation, the roadways segment dominated the market in 2024, attributed to its extensive transportation network and ongoing fleet electrification efforts.

- By mode of operation, the airways segment is expected to grow at the fastest CAGR between 2025 and 2034, driven by the emergence of sustainable aviation fuels and carbon-neutral air cargo initiatives.

- By end-use, the retail and e-commerce sector accounted for the largest market share in 2024, reflecting the surge in online retailing and the adoption of eco-friendly packaging and delivery practices.

- By end-use, the manufacturing segment is forecast to expand rapidly through 2034, bolstered by industrial decarbonization programs and increased investment in green supply chain systems.

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

What is green logistics?

The green logistics market refers to the production, distribution, and use of green logistics, which is defined as logistics done without harming the environment. They aim to reduce carbon footprints and be involved in sustainable practices throughout the logistics journey. Green logistics, also known as sustainable logistics, eco-logistics, good logistics, and humanitarian logistics. Green logistics describes all attempts to measure and minimize the ecological impact of logistics activities.

Green logistics helps to reduce the distance and number of goods transport operations, especially those that involve combustion vehicles, which emit greenhouse gases that are harmful to the environment. The main benefit of green logistics is its ability to reduce the environmental footprint of business operations. Green logistics adoption practices help to reduce environmental impact, ensure compliance, improve reputation, and achieve cost savings.

Private Industry Investments in Green Logistics:

- GreenLine Mobility (Essar Group) – India (~US$275 million) - GreenLine Mobility committed around US$275 million to decarbonize India's heavy trucking sector. The investment includes deploying over 10,000 LNG and electric trucks, and developing 100 LNG refueling stations, along with EV charging and battery-swapping infrastructure. The initiative aims to reduce about 1 million tonnes of CO₂ annually.

- Hindustan Zinc + GreenLine Mobility – India (₹ 400 crore) - Hindustan Zinc partnered with GreenLine to invest ₹400 crore in deploying 100 electric trucks and 100 LNG trucks, along with India’s first commercial battery-swapping infrastructure. This project is designed to significantly reduce long-haul and Scope 3 emissions in logistics operations.

- DP World & AM Green / Greenko Group – Green Fuel Logistics Infrastructure - DP World partnered with AM Green to develop global logistics infrastructure for green fuels like ammonia and methanol. The project supports the storage, transportation, and bunkering of 1 million tonnes per year of each fuel across India, the Middle East, and Southeast Asia.

- Amazon – Electric Heavy Truck Fleet Expansion (UK) - Amazon made the UK’s largest order of electric heavy goods vehicles (over 140 electric trucks), including Mercedes-Benz and Volvo models. This forms part of Amazon’s broader investment in green logistics, which also includes extensive electric vehicle charging infrastructure across its UK operations.

-

Einride – Electric & Autonomous Freight Network (~US$100 million) - Swedish startup Einride raised about US$100 million to expand its fleet of electric and autonomous freight trucks globally. The company has demonstrated autonomous, cabless freight transport across international borders, focusing on software-driven logistics and emissions reduction.

Case Study: GreenLine Mobility’s USD 275 Million Drive to Decarbonize India’s Heavy Trucking Sector

Background:

In April 2025, GreenLine Mobility Solutions Ltd., a subsidiary of the Essar Group, unveiled one of India’s most ambitious green logistics programs a USD 275 million investment aimed at decarbonizing the nation’s heavy trucking segment. The initiative marked a turning point in India’s logistics sustainability roadmap, aligning with the government’s long-term net-zero vision and growing corporate ESG commitments. The project is designed to transition freight movement from high-emission diesel trucks to liquefied natural gas (LNG) and electric vehicle (EV) alternatives across major logistics corridors.

Challenge:

India’s logistics ecosystem contributes nearly 14% of national CO₂ emissions, with long-haul trucking being a primary culprit. Heavy reliance on diesel fuel, limited availability of green refueling stations, and the absence of large-scale fleet electrification hindered decarbonization progress. GreenLine Mobility identified the urgent need to introduce scalable, clean-fuel infrastructure and affordable technology models capable of delivering both operational efficiency and environmental benefits.

Solution:

To address these challenges, GreenLine Mobility initiated a phased decarbonization strategy that includes:

- Deployment of 10,000+ LNG and electric trucks across India by 2028.

- Establishment of 100 LNG refueling stations and EV charging and battery-swapping hubs to ensure energy access across long routes.

- Integration of AI-enabled route optimization and telematics systems for real-time emission tracking, safety management, and efficiency monitoring.

- Collaboration with major clients such as Hindustan Zinc, JSW Steel, and Flipkart to anchor demand and validate economic viability.

Implementation:

The rollout began in Western India, connecting industrial hubs in Maharashtra and Gujarat with key mining and manufacturing zones. LNG trucks were prioritized for long-distance transport due to their high energy density and fast refueling capability, while electric trucks were introduced for intra-state and last-mile operations.

The company also partnered with global OEMs like Volvo and Tata Motors to co-develop customized green freight vehicles suited to Indian road conditions. Each operational fleet is backed by a digital twin logistics platform that monitors mileage, emission savings, and fuel utilization in real time.

Results:

By mid-2025, GreenLine Mobility reported operating over 1,200 LNG trucks, achieving a cumulative reduction of 10,000 tonnes of CO₂ after covering more than 38 million kilometers. The initiative not only demonstrated environmental benefits but also improved fuel cost efficiency by nearly 20% compared to conventional diesel operations.

Furthermore, the model’s success led to replication discussions with regional logistics operators and strengthened investor confidence in India’s clean-mobility sector. GreenLine’s data-driven approach has positioned it as a benchmark for large-scale, private-sector-led logistics decarbonization.

Key Takeaways:

- Scalability: Demonstrates that large-scale private investments can accelerate green logistics transformation even in developing markets.

- Infrastructure Synergy: Integrating clean fuel networks (LNG + EV) supports fleet reliability and transition readiness.

- Technology Enablement: Digital monitoring and AI analytics ensure transparency and measurable ESG outcomes.

- Collaborative Model: Partnerships with industrial clients anchor operational demand, ensuring long-term project viability.

Strategic Insight:

The GreenLine Mobility initiative underscores the commercial feasibility and environmental necessity of green logistics investments. As India and other emerging economies scale sustainable transportation infrastructure, such cross-sector collaborations provide a replicable blueprint for carbon-neutral logistics networks worldwide.

What are the Major Trend of the Green Logistics Market?

- Electrification of Transportation Fleets: Logistics providers are rapidly adopting electric vehicles (EVs), including trucks, vans, and last-mile delivery bikes, to reduce greenhouse gas emissions and comply with stricter emissions regulations. This shift is fueled by advancements in battery technology and increased EV infrastructure.

- Carbon Tracking and Emission Transparency: There is growing demand for real-time carbon footprint tracking and sustainability reporting across supply chains. Logistics companies are implementing digital tools that provide detailed insights into emissions data, enabling businesses to meet ESG goals and regulatory requirements.

- Sustainable Packaging Solutions: Companies are reducing waste by using biodegradable, recyclable, or reusable packaging materials. Minimizing packaging size and weight also helps cut emissions during transport, aligning with broader sustainability goals.

- Green Warehousing and Infrastructure: Warehouses are being retrofitted or newly constructed with solar panels, LED lighting, energy-efficient HVAC systems, and smart energy management systems. These green facilities reduce energy consumption and improve operational efficiency.

-

Circular Supply Chains Reverse Logistics & Sustainable Packaging: Companies are designing supply chains to close the loop: reverse logistics (returns, recycling, refurbishment) are more integrated. Packaging is becoming more sustainable: recyclable, biodegradable, reusable, minimal waste. Reducing single-use plastics etc.

According to Yogesh Kulkarni Research Director at Statifacts, the logistics sector is witnessing a structural shift as decarbonization becomes a commercial imperative. With investments flowing into electric fleets, low-carbon fuels, and smart warehousing, companies are realigning their supply chain strategies to meet both regulatory compliance and sustainability goals simultaneously.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/8373

Green Logistics Market Dynamics

Driver

-

Growing demand for sustainability:

The growing demand for sustainability in green logistics benefits includes better brand credibility, a stronger connection with customers, reduced waste, and a decrease in gas emissions. Sustainable practices for green logistics include employing companies that specialize in the logistics process outsourcing, ensuring that the warehouse operates effectively, reducing waste production and energy consumption, using renewable resources for manufacturing, and finding environmentally friendly goods and services.

Restraint

-

Implementation complexity:

Green logistics initiatives can be complex to implement and require coordination across many stakeholders and departments. The most significant restraint in implementing sustainable logistics practices is the high initial costs. It also includes customer expectations, regulatory challenges, technological barriers, lack of standardization, and complex supply chain management. Transitioning to eco-friendly vehicles, sustainable packaging materials, and renewable energy sources needs substantial investment.

Opportunity

-

Developing smart logistics infrastructure:

Smart logistics aims to achieve an effective and cost-effective logistics system by enhancing logistics processes. By utilizing artificial intelligence (AI) in smart logistics infrastructure, logistics processes can be automated through data analysis and predictive capabilities. Investing in logistics application development improves efficiency, allows data-driven decision-making, and gives a competitive benefit. Through automation of logistics processes, we can save time and money and also ensure timely and accurate delivery.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8240

Green Logistics Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 1,507.02 Billion | |

| Market Size in 2025 | USD 1,630.6 Billion | |

| Market Size in 2031 | USD 2,616.43 Billion | |

| Market Size by 2034 | USD 3,314.3 Billion | |

| CAGR 2025-2034 | 8.2% | |

| Leading Region in 2024 | Asia Pacific | |

| Fastest Growing Region | North America | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Business Type, By Mode of Transportation, By End-use, and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | United Parcel Service, Bowling Green Logistics, GEODIS, Yusen Logistics Co., Ltd, DHL International GmbH, XPO Logistics, DB SCHENKER, Kuehne + Nagel, CEVA Logistics, Agility Public Warehousing Company K.S.C.P., and Others. | |

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Green Logistics Market Segmentation

Business Type Insights

What Made the Warehousing Segment Lead the Green Logistics Market?

The warehousing segment led the market in 2024. Green warehousing reduces costs, boosts efficiency, and builds sustainable logistics. Green warehousing improves brand reputation, enhances air quality, minimizes waste, mitigates risk, offers value-added services, improves order fulfilment, and reduces energy costs. It helps companies to strengthen customer loyalty and meet environmental regulations by aligning with sustainability values.

The distribution segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Green logistics distribution benefits include reduced losses, actionable insights, better image, lower packaging costs, reduced transport costs, and reduced pollution. Implementing green logistics in supply chain management can help to address climate change by reducing its carbon footprint. The benefits of the distribution of green logistics also include inventory management, energy management, sustainable packaging, efficient load planning, and improved transportation.

Mode of Transportation Insights

Ho Roadways Segment Dominate the Green Logistics Market?

The roadways segment dominated the market in 2024. The main benefit of road transport. It is the most profitable, fastest, most agile, and flexibility of schedules and volumes. Roadways are important for different types of vehicles to transport people and materials from one place to another place on an economical way over a short distance, including goods like vegetables, fruits, and other greeneries. Road transport does not need a station, or sea port, or an airport. It can cover short distances quickly and easily.

The airways segment is projected to expand rapidly in the market between 2025 to 2034. The key benefits of airway transportation include high cargo load capacity, reduced physical barriers, safety, global connectivity, dependability, and speed. These factors make it a preferred choice for time-sensitive and long-distance shipping. Air transport is one of the fastest modes of public transport, which connects international boundaries. Air transport enables people from different countries to cross international boundaries and travel to other countries for medical, business, personal, and tourism purposes.

End-use Insights

Which End-use Segment Lead the Green Logistics Market?

The retail and e-commerce segment led the market in 2024. Reasons for retail and e-commerce businesses to implement green logistics include compliance with regulations, improved efficiency, enhanced brand image, cost savings, and reduced environmental impact. By improving processes like shipping, warehousing, and inventory management. eCommerce logistics helps to reduce operational costs. This includes leveraging bulk shipping discounts, minimizing storage expenses, and enhancing inventory turnover. E-commerce technology proceeds to deliver enterprise-level insights at an expense that’s reasonable for e-commerce industries.

The manufacturing segment is set to experience the fastest rate of market growth from 2025 to 2034. Sustainable practices are costly, but green manufacturing may lead to long-term cost savings. Energy-efficient technologies reduce utility bills, waste reduction strategies minimize disposal costs, and streamlined processes improve overall operational efficiency. Green products help to reduce the environmental footprint by minimizing waste and lowering carbon emissions. Green productivity is a strategy for improving a business's productivity and environmental performance at the same time, for overall socio-economic development.

Regional Insights

Asia Pacific Green Logistics Market

Asia Pacific dominated the market in 2024 due to greenhouse technologies, sustainable packaging, logistics optimization, growing adoption of electric vehicles (EVs), e-commerce growth, shifting consumer preferences, ESG (Environmental, Social, and Governance) initiatives, and environmental regulations in the region. Green logistics is key to India’s sustainable future, with transportation offering the greatest potential for emissions reduction. Government initiatives that support green logistics and raise consumer awareness of greenhouse gas emissions are driving market growth. Rapid digital integration and adoption of alternative fuels like LNG and SAF are also expanding market with large emphasis on are housing support to e-commerce and sustainable operations.

China dominates the regional market due to its massive manufacturing base, strong government policies supporting low-emission transport, and heavy investments in sustainable infrastructure. The Chinese government has implemented subsidies for electric freight vehicles, promoted a shift from road to rail and sea transport, and enforced strict environmental regulations. Additionally, China's rapid e-commerce growth and urbanization have accelerated the need for efficient, low-carbon logistics solutions. With advanced adoption of electric vehicles, smart logistics technologies, and renewable-powered warehousing, China leads the region in scaling green logistics practices.

North America Green Logistics Market Trends

North America is expected to show the fastest growth in the forecast period of 2025 to 2034 because of the circular economy practices, focus on sustainable infrastructure, growing demand for eco-friendly products & services, e-commerce growth, smart warehousing, increasing adoption of electric vehicles (EVs), supportive government policies, and stricter environmental regulations in the region. Well-known supply chain companies in the US can provide a massive range of services, including customs clearance, project logistics, warehousing, and freight forwarding.

The U.S. dominates the regional market due to its vast and advanced logistics infrastructure, strong regulatory support, and significant private-sector investment. With federal and state incentives promoting the adoption of electric vehicles, renewable energy in warehousing, and emissions reduction technologies, the U.S. has created a favorable environment for green logistics growth. Major logistics companies like FedEx and UPS are leading the way by electrifying fleets and integrating sustainable practices across supply chains.

Browse More Research Reports:

- The global feed logistics services market, valued at USD 25.68 billion in 2024, is forecast to reach USD 40.27 billion by 2034, growing at a 4.6% CAGR as demand for efficient supply chains and livestock nutrition management rises worldwide.

- The global cash logistics services market, valued at USD 23.25 billion in 2024, is projected to reach USD 28.62 billion by 2034, growing at a 2.1% CAGR as banks and businesses maintain demand for secure cash handling, transport, and ATM services.

- The global drone delivery logistics market, valued at USD 606 million in 2024, is forecast to hit USD 4,354.57 million by 2034, growing at a robust 21.8% CAGR as demand for faster, cost-effective, and contactless delivery solutions rises.

- The global logistics robotics market size was evaluated at USD 10,230 million in 2024 and is expected to grow around USD 44,740 million by 2034, registering a CAGR of 15.9% from 2025 to 2034.

- The global halal logistics market size surpassed USD 395.03 billion in 2024 and is predicted to reach around USD 1,006.13 billion by 2034, registering a CAGR of 9.8% from 2025 to 2034.

- The global clinical trials supply and logistics market size was calculated at USD 4,310 million in 2024 and is predicted to attain around USD 9,290 million by 2034, expanding at a CAGR of 7.98% from 2025 to 2034.

- The global inbound logistics market size was evaluated at USD 1,569.29 billion in 2024 and is expected to grow around USD 3,356.74 billion by 2034, registering a CAGR of 7.9% from 2025 to 2034.

- The global automotive logistics market size was estimated at USD 230.8 billion in 2024 and is projected to be worth around USD 502.91 billion by 2034, growing at a CAGR of 8.1% from 2025 to 2034.

- The U.S. clinical trials supply and logistics market size was exhibited at USD 1,319 million in 2024 and is projected to hit around USD 2,744 million by 2034, growing at a CAGR of 7.6% during the forecast period 2024 to 2034.

- The global reverse logistics market size is calculated at USD 1,193 million in 2024 and is predicted to reach around USD 3,773 million by 2034, expanding at a CAGR of 12.2% from 2024 to 2034.

- The packing film for logistics market is valued at USD 443 million in 2023 and is projected to reach USD 703.93 million by 2034, growing at a CAGR of 4.3%.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/8240

Green Logistics Market Top Companies

- United Parcel Service of America, Inc. - UPS is investing heavily in alternative fuel vehicles and carbon-neutral shipping options to reduce its environmental footprint.

- Bowling Green Logistics - Bowling Green Logistics incorporates eco-friendly routing technologies and fuel-efficient fleets to support sustainable transportation solutions.

- GEODIS - GEODIS offers carbon footprint tracking tools and emphasizes multimodal transport solutions to minimize CO₂ emissions in supply chains.

- Yusen Logistics Co., Ltd. - Yusen Logistics promotes green logistics through its Eco-Friendly Distribution service, focusing on energy-saving warehouses and low-emission transport modes.

- DHL International GmbH - DHL has committed to achieving zero emissions by 2050 and supports customers with its GoGreen logistics services.

- XPO Logistics, Inc. - XPO Logistics integrates energy-efficient technologies and real-time optimization software to enhance the sustainability of its supply chain services.

- DB SCHENKER - DB Schenker provides green transport solutions, including electric delivery trucks and sustainable warehousing, to lower carbon emissions.

- Kuehne + Nagel - Kuehne + Nagel offers customers CO₂-neutral transport options and detailed emissions reporting to promote climate-conscious logistics.

- CEVA Logistics - CEVA focuses on reducing environmental impact through route optimization and investment in electric vehicle fleets.

- Agility Public Warehousing Company K.S.C.P. and Subsidiaries - Agility emphasizes green warehousing and logistics, including solar-powered facilities and carbon-reduction programs for clients.

- Bolloré SE - Bolloré SE incorporates hybrid and electric vehicles in its fleet and develops green hubs to support sustainable logistics networks.

- Deutsche Post DHL Group - Deutsche Post DHL Group leads in green logistics with science-based targets and extensive use of electric vehicles across its operations.

- DSV - DSV offers sustainable transport options, carbon reporting, and a strong commitment to transitioning to low-emission logistics solutions.

- FedEx Corporation - FedEx is working toward carbon-neutral operations by 2040, investing in electric delivery vehicles and sustainable aviation fuel.

Recent Developments

- In August 2025, one of the country’s largest green logistics transitions in partnerships with GreenLine Mobility Solutions Ltd. was launched by Hindustan Zinc Limited (HZL). With this partnership, HZL has accelerated its push towards obtaining 100% decarbonization of its supply chain through the deployment of advanced electric vehicle (EV) and Liquified Natural Gas (LNG) trucks. Source: The Indian Express

- In May 2025, a next-generation Distribution Center (DC) in Bhiwandi, Maharashtra, featuring a Digital Twin for intelligent planning, a green logistics model aimed at reducing emissions and resource consumption, was launched by Nestle India in a bold move to redefine supply chain innovation. This Bhiwandi DC has been newly launched, and stands out as the company’s first facility to feature a Digital Twin, an innovative simulation tool that allows virtual scenario planning for warehouse operations. Source: Logistics Insider

- In August 2025, the FedEx SMART Center (Supply Chain Modelling, Algorithms, Research and Technology Center) on the IIT Madras campus was launched by the Indian Institute of Technology (IIT) Madras, in partnership with FedEx Corporation. This center will work on creating technology-led and sustainable logistics solutions. Source: Best Colleges India Today

- In July 2025, the Brave Future Vessel to boost green logistics was officially launched by Braskem, a global leader in biopolymer production and a major player in the petrochemical sector. This vessel represents a step in the company’s long-term strategy to reinforce global competitiveness, improve logistic autonomy, and optimize maritime transport costs. Source: Mexico Business

Green Logistics Market Segments Covered in the Report

By Business Type

- Warehousing

- Distribution

- Value-added services

By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

By End-use

- Healthcare

- Manufacturing

- Automotive

- Banking and financial services

- Retail and E-Commerce

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Explore More Reports:

- Vitamin D Market - https://www.statifacts.com/outlook/vitamin-d-market

- Bamboo Flooring Market - https://www.statifacts.com/outlook/bamboo-flooring-market

- Spine Biologics Market - https://www.statifacts.com/outlook/spine-biologics-market

- Membrane Oxygenator Market - https://www.statifacts.com/outlook/membrane-oxygenator-market

- Hydrazine Hydrate Market - https://www.statifacts.com/outlook/hydrazine-hydrate-market

- Chelants Market - https://www.statifacts.com/outlook/chelants-market

- Cricket Equipment Market - https://www.statifacts.com/outlook/cricket-equipment-market

- Wafer-Level Vacuum Laminator Market - https://www.statifacts.com/outlook/wafer-level-vacuum-laminator-market

- Quantum Encryption Communication Modules Market - https://www.statifacts.com/outlook/quantum-encryption-communication-modules-market

- Automotive Copper Core Cable Market - https://www.statifacts.com/outlook/automotive-copper-core-cable-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.